Traders find it challenging to completely avoid emotional influences, because human beings are inherently emotional and psychological factors play a significant role in trading. Here are some primary reasons that contribute to traders’ difficulty in avoiding emotional influences:

- Physiological Reactions: Trading decisions involve the emotional center of the brain, and emotions are closely related to physiological reactions. Potential losses or high-risk trades can trigger stress responses, such as increased heart rate and sweating, which further impact traders’ decision-making.

- Pressure and Anxiety: Traders face market fluctuations and uncertainties, leading to pressure and anxiety. Emotions are triggered when traders encounter potential losses or missed opportunities for profits, affecting their decision-making process.

- Greed and Fear: Greed and fear are common emotions in trading. When traders see profits, greed can make them overconfident and potentially lead to overtrading. Conversely, in the face of market losses, fear may prompt them to close losing trades prematurely.

- Loss Aversion: People have a strong aversion to losses and often strive to avoid them, which may result in reluctance to admit mistakes or delay in setting stop-loss orders.

- Cognitive Biases: Traders can be influenced by cognitive biases when processing information, such as overconfidence, excessive optimism, or excessive pessimism, leading to irrational decision-making.

- Mental Accounting: Traders often mentally categorize funds into different accounts, such as investment accounts or entertainment accounts, leading to different emotional reactions to each account. For instance, facing losses in an investment account, a trader might attempt to make risky trades in the entertainment account to compensate for the losses.

- Inertia: Some traders may be inclined to stick to previous trading patterns and are unwilling to adjust strategies or recognize changes in the market.

- Herd Mentality: Market sentiment and others’ opinions often influence traders’ judgments and decisions, causing them to follow the crowd or blindly conform to popular beliefs.

Considering these factors, it becomes evident that achieving long-term profitability for retail traders is challenging, and even experienced traders may need a decade or more of trading experience to effectively mitigate emotional influences.

Is there an effective tool for retail traders to reduce emotional trading impacts? The answer is yes, and that’s quantitative trading strategies. Quantitative trading relies on high-performance computers to execute trades, fundamentally avoiding emotional influences on trading outcomes.

Are there any recommended quantitative trading platforms?

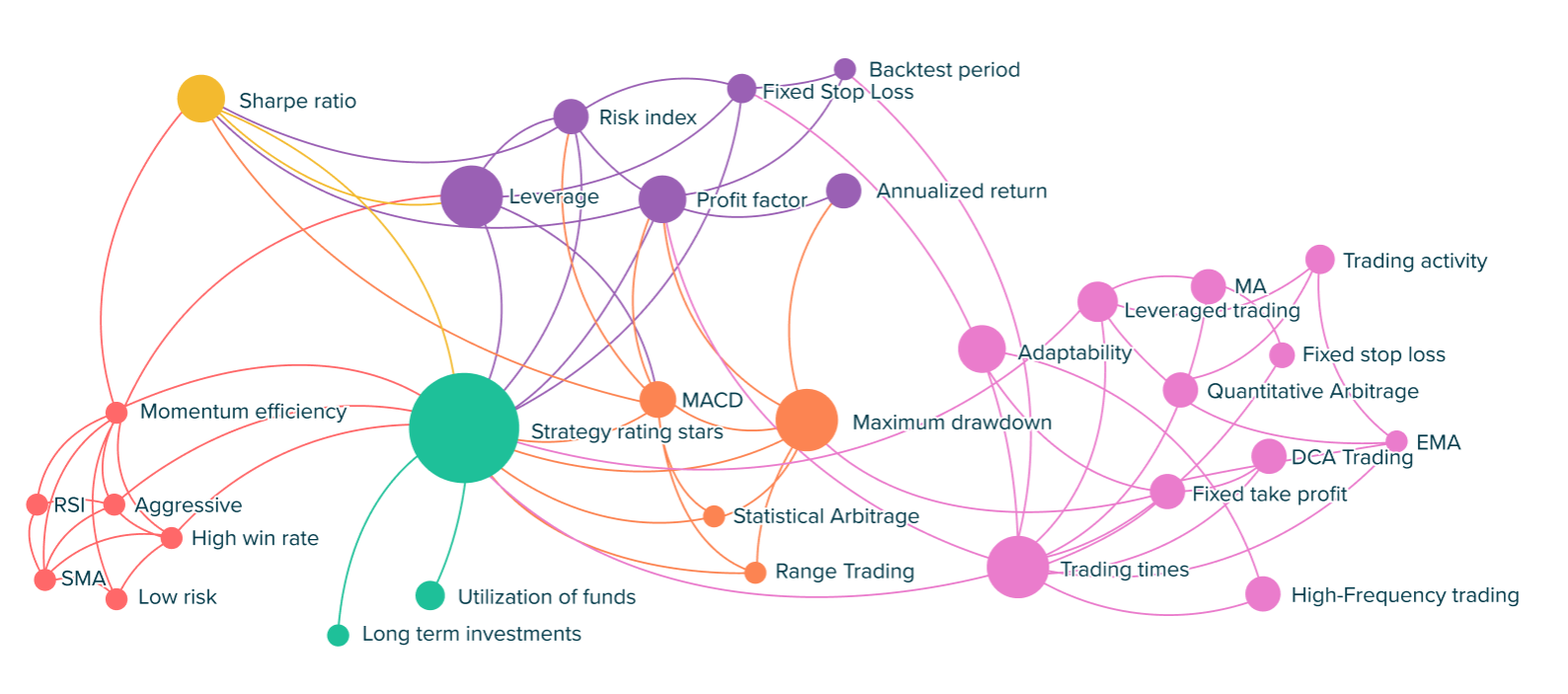

ATPBot is the best choice for quantitative trading. Unlike traditional quantitative trading platforms, ATPBot uses AI engines to generate strategies with strong profit potential. Some advantages of ATPBot include:

- Providing 24/7 automatic AI trading strategies: ATPBot’s team develops and provides specific AI trading strategies that run continuously 24/7, covering both daytime and nighttime trading sessions. These strategies continuously monitor the market and make accurate trading decisions.

- Experienced strategy modeling team: ATPBot’s team has over 20 years of experience and manages nearly $1 billion in funds. They will utilize their expertise to design strategy models tailored to your needs.

- Powerful computing support: ATPBot offers substantial computing power to assist in identifying optimal strategy configuration parameters. Through high-performance computing and optimization algorithms, ATPBot can quickly and accurately find the best configuration parameters, enhancing your trading performance.

- Time-saving and emotion-free trading: ATPBot’s goal is to save you time and eliminate emotional influences on your trades. With automated trading and AI strategies, you can leave trading decisions to the system, avoiding emotional decisions and human errors.

- Complete transparency in fund management and trading information: Your funds will always remain in your exchange account, and ATPBot cannot access your funds, ensuring the utmost security. ATPBot only requires your trading permission API Key to begin automated trading. All trading actions take place in your exchange account, and you can monitor them at any time.

- Strong profit potential: ATPBot’s strategies undergo rigorous testing and optimization to ensure exceptional profitability in the market. ATPBot’s actual trading results far exceed the performance of most funds and private investments in the market, providing you with higher returns and investment yields.

As a new generation AI-based quantitative trading platform, ATPBot stands out both in performance and user experience. Traders looking to experience the thrill of making money may consider trying ATPBot.