In the fast-paced world of finance, staying ahead of the curve is crucial for successful investing. Enter the era of AI trading bot, revolutionizing the way we approach financial markets. These intelligent systems leverage artificial intelligence and machine learning to analyze market trends, execute trades, and optimize investment portfolios. Let’s delve into the fascinating realm of AI trading and explore how they are reshaping the landscape of modern investing.

What Is AI Trading Bot?

AI trading bot represents the pinnacle of technological advancement in the financial sector. It’s a financial activity executed through intelligent computer programs, aiming to achieve more efficient trading in markets such as stocks, forex, cryptocurrencies, and more. It provides investors with smarter and more efficient trading solutions. By combining data science, mathematical modeling, and computer science, AI trading play an increasingly vital role in financial decision-making, delivering more reliable and innovative trading experiences for market participants.

How Do AI Trading Bot Work?

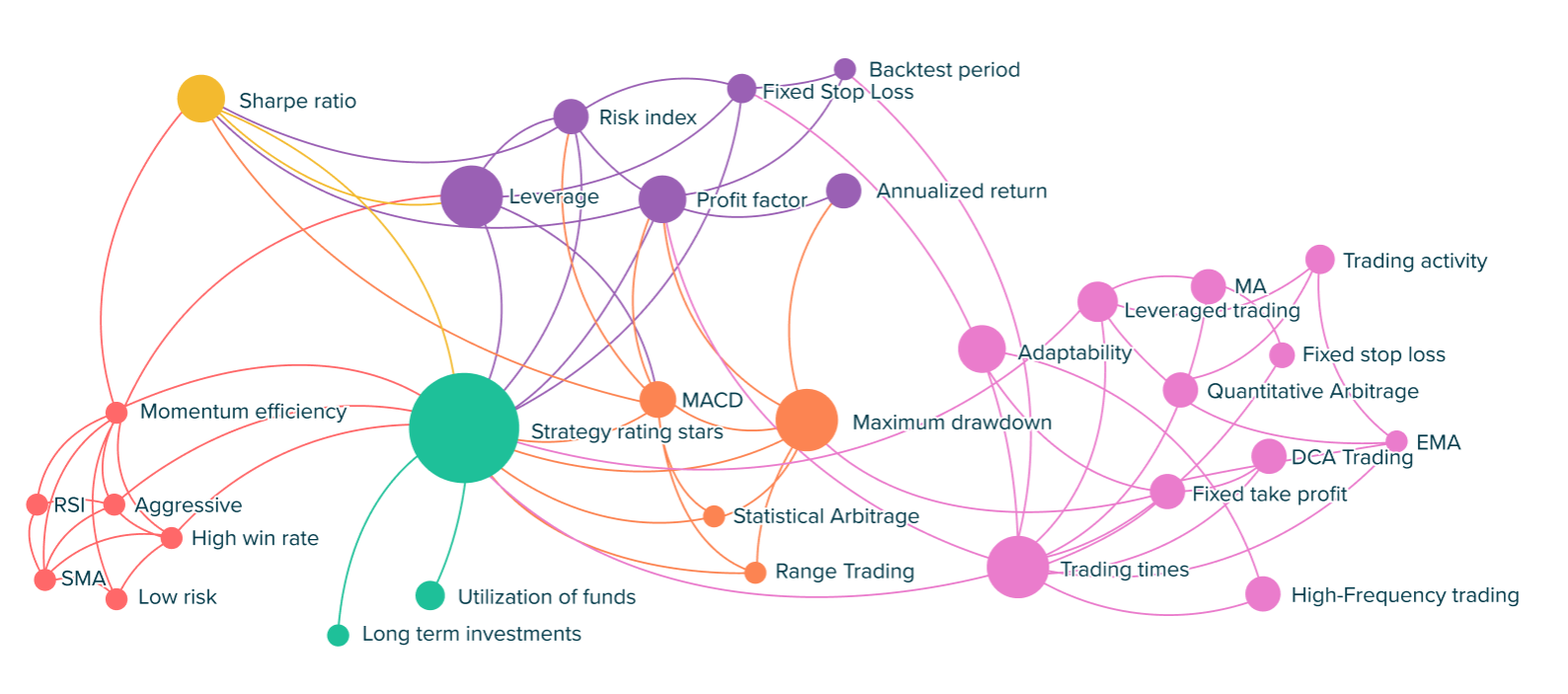

AI trading bot is designed to learn, adapt, and make data-driven decisions in real-time. By harnessing the power of algorithms, they can swiftly analyze vast amounts of market data, identifying patterns and trends that might go unnoticed by human traders. This not only enhances decision-making speed but also improves the accuracy of investment strategies.

Key Features and Benefits:

- Automated Analysis: AI trading bot can process and analyze market data 24/7, providing a level of efficiency that traditional trading methods struggle to match. This continuous analysis ensures that no lucrative opportunities are overlooked.

- Adaptability: The dynamic nature of financial markets requires adaptive strategies. AI excel at adjusting their approach based on evolving market conditions, ensuring a proactive response to changes in trends and volatility.

- Risk Management: AI come equipped with sophisticated risk management tools. By setting predefined parameters, investors can control risk levels and protect their investments from unexpected market fluctuations.

- Portfolio Diversification: AI trading bot enable users to diversify their investment portfolios across various assets and markets. This diversification helps spread risk and optimize returns.

- Backtesting and Learning: Historical data is essential for refining trading strategies. AI trading bot conduct backtesting, learning from past market behavior to improve future decision-making. This iterative learning process contributes to the continuous enhancement of the bot’s performance.

- Time Efficiency: Traditional trading requires constant monitoring, but AI trading bots operate autonomously, freeing up valuable time for investors. This allows individuals to participate in the markets without being tethered to their screens.

How to Profit with AI Trading bot?

As the pinnacle of global financial technology, is a solution provided by only a handful of companies, with ATPBot being the most technologically mature among them.

Profiting in the cryptocurrency market has always been the goal for investors, and ATPBot offers an intelligent and efficient way to achieve this objective. Through advanced strategy modeling and data analysis, ATPBot can identify opportunities in market fluctuations and make rapid and precise trading decisions.

With ATPBot, you can enjoy round-the-clock market monitoring and swift execution capabilities, adapting flexibly to both rising and falling markets. Its unique algorithms and intelligent trading system provide you with a powerful tool to achieve stable and substantial returns in the cryptocurrency market.

ATPBot eliminates the need for extensive market analysis and manual trading, offering a convenient and efficient solution for your investments, enhancing your performance in the cryptocurrency sector.