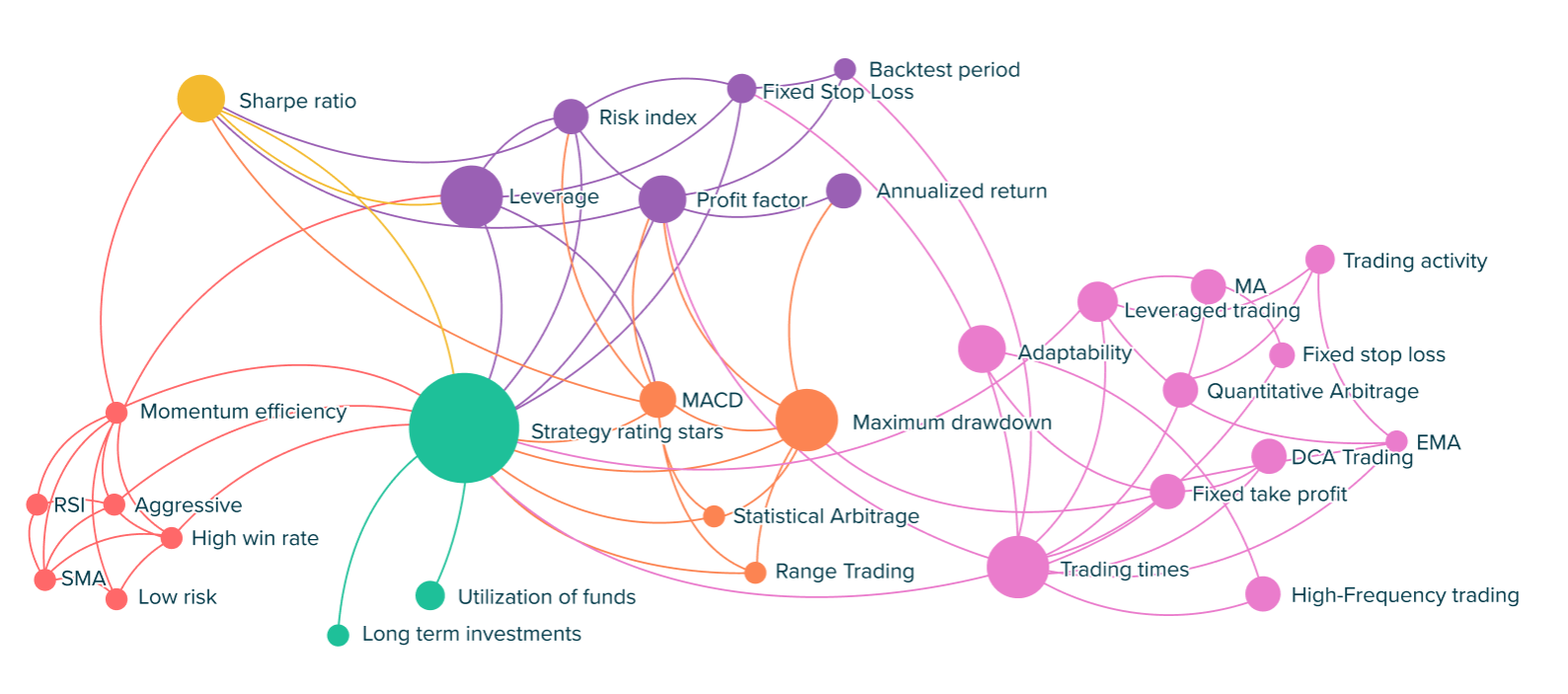

The plunge seen in the first half of March was stopped by the bullish order block (OB) formed on 13 March at $5.386 (white). At press time, DOT bears had breached the previous support zone of $5.60 – $5.87 (cyan), but the downtrend eased at the March low.

Technical indicators didn’t show a reversal at that time. However, the Relative Strength Index (RSI) was near the oversold zone with a flat movement. It showed selling pressure increased but eased slightly at that time – will seller exhaustion give room for bulls?

Moreover, the Chaikin Money Flow (CMF) had an uptick – an indication of a slight improvement in capital inflows for DOT. If the trend persists, DOT could rebound from its March low ($5.15) and rally to the February support level of $6.05 or higher resistance levels at $6.6 or $7.

If that’s the case, buying above bullish OB at $5.386, targeting $6.05, could offer a good risk ratio. Overly ambitious targets can be placed at $6.6 and $7.

A daily session close below $5.15 will invalidate the thesis. Such a drop could push DOT to $4.997 or the December low of $0.4260.

According to Santiment, DOT saw low trading volumes in the past few days. However, there was a slight improvement on 8 May after DOT retested the March low of $5.15.

The move was accompanied by improved weighted sentiment, too – implying that bulls are keen to defend the March low. However, the fluctuating funding rates could undermine a strong recovery.