Explore ATPBot’s comprehensive risk management strategy, membership advantages, and rationale behind backtest-focused results presentation, providing insight into its innovative approach to trading and investment.

Question: How does ATPBot manage risk?

ATPBot employs several measures to control risk and ensure the safety of investors’ funds: 1. Capital Risk: ATPBot doesn’t handle users’ investment funds directly. It connects to users’ exchanges through APIs and executes trades using AI strategies to potentially generate returns.

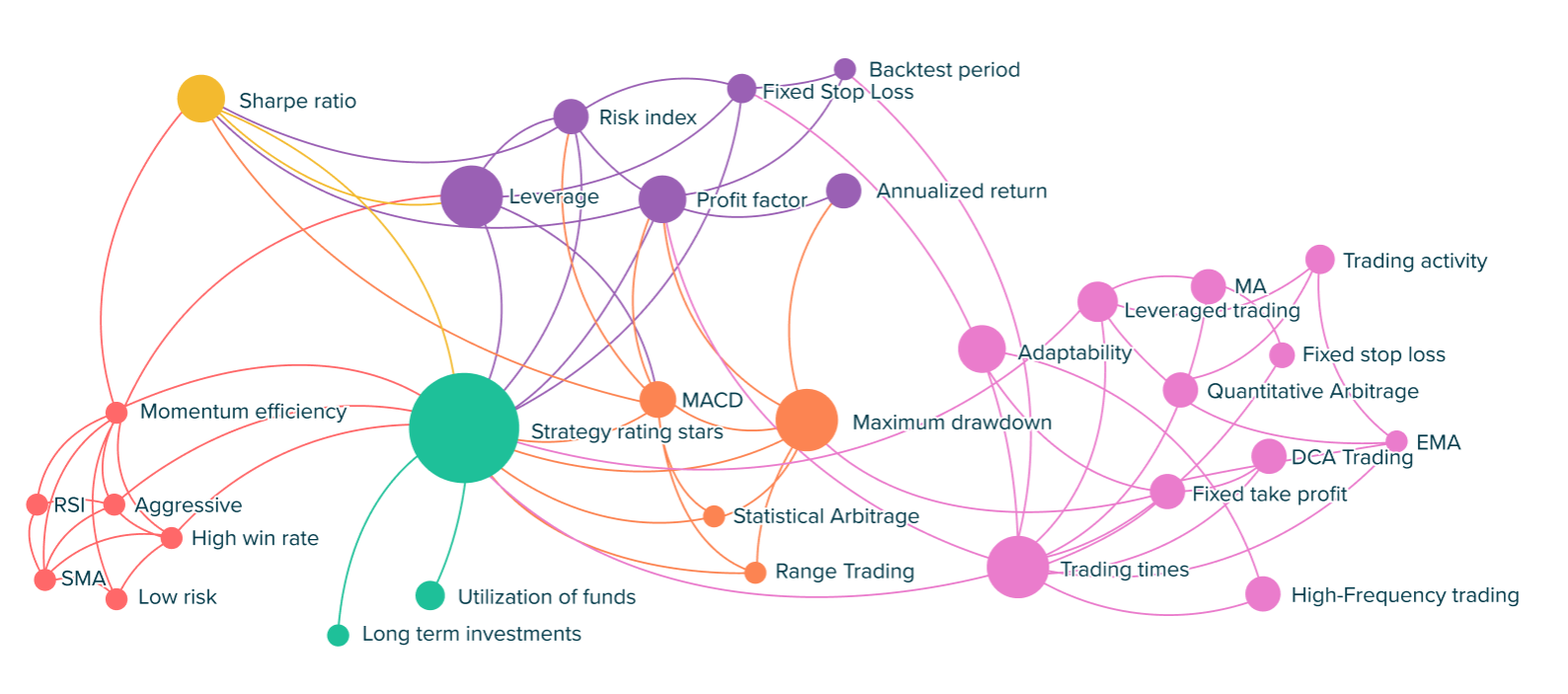

2. Risk Management and Trading: We utilize specific margin models and strict stop-loss strategies during trading to define potential trading risks. These risk factors are fully, clearly, and accurately disclosed.

3. Network and System Risks: ATPBot operates on Amazon’s top-tier servers for executing clients’ strategies. We also use our own state-of-the-art AI servers for strategy calculations and maintain a secure data backup system to mitigate network and system risks.

Question: Why become an ATPBot member?

Becoming an ATPBot member offers several advantages compared to traditional trading and investment methods: 1. No need to hire professional traders, saving time and money.

2. Eliminates the need to code automated trading programs, as our expert team has already done it for you.

3. No costs associated with purchasing hardware or leasing AI servers; we handle all data backtesting and optimization.

4. AI system filters best strategies, removing the need for manual calculation and statistics.

5. Bypasses the hassle of coding trading strategies; switching strategies becomes more convenient.

6. No requirement to manage dedicated servers independently; we handle all operational aspects.

All these advantages come with the ATPBot Basic Membership fee, priced at just $999 per year.

Question: Why does ATPBot provide backtest results but not live trading results?

We’ve chosen to provide backtest results over live trading results for the following reasons:

1. Personalized Strategies: We have confidence in our strategy modeling team and computational capabilities. Each user employs a unique strategy, ensuring stability in profit over longer cycles.

2. Unpredictability of the Future: Any strategy’s performance is influenced by changes in market conditions and fitting over its execution period. Extensive backtesting enhances the probability of profitability across various scenarios.

3. Limitations of Live Trading: Live trading results are historical for new users. Moreover, positive live results attract more customers and funds, increasing real-time risk and the need for deeper market involvement and competition, which isn’t conducive to long-term investors.

In summary, ATPBot focuses on offering backtest results to showcase its potential effectiveness due to the reasons mentioned above, helping investors make more informed decisions.

Download here