Navigating the Crypto Markets with Algorithmic Precision

A cryptocurrency trading algorithm is a sophisticated system of rules and instructions designed to automate the buying and selling of cryptocurrencies. These algorithms leverage data analysis, technical indicators, and predefined strategies to make trading decisions without human intervention. Let’s break down the key elements that constitute a crypto trading algorithm:

- Data Collection and Analysis:

Cryptocurrency trading algorithms rely on accurate and real-time data from various sources, including cryptocurrency exchanges, news feeds, social media sentiment, and technical indicators. Data analysis helps identify market trends and potential trading opportunities.

- Technical Indicators:

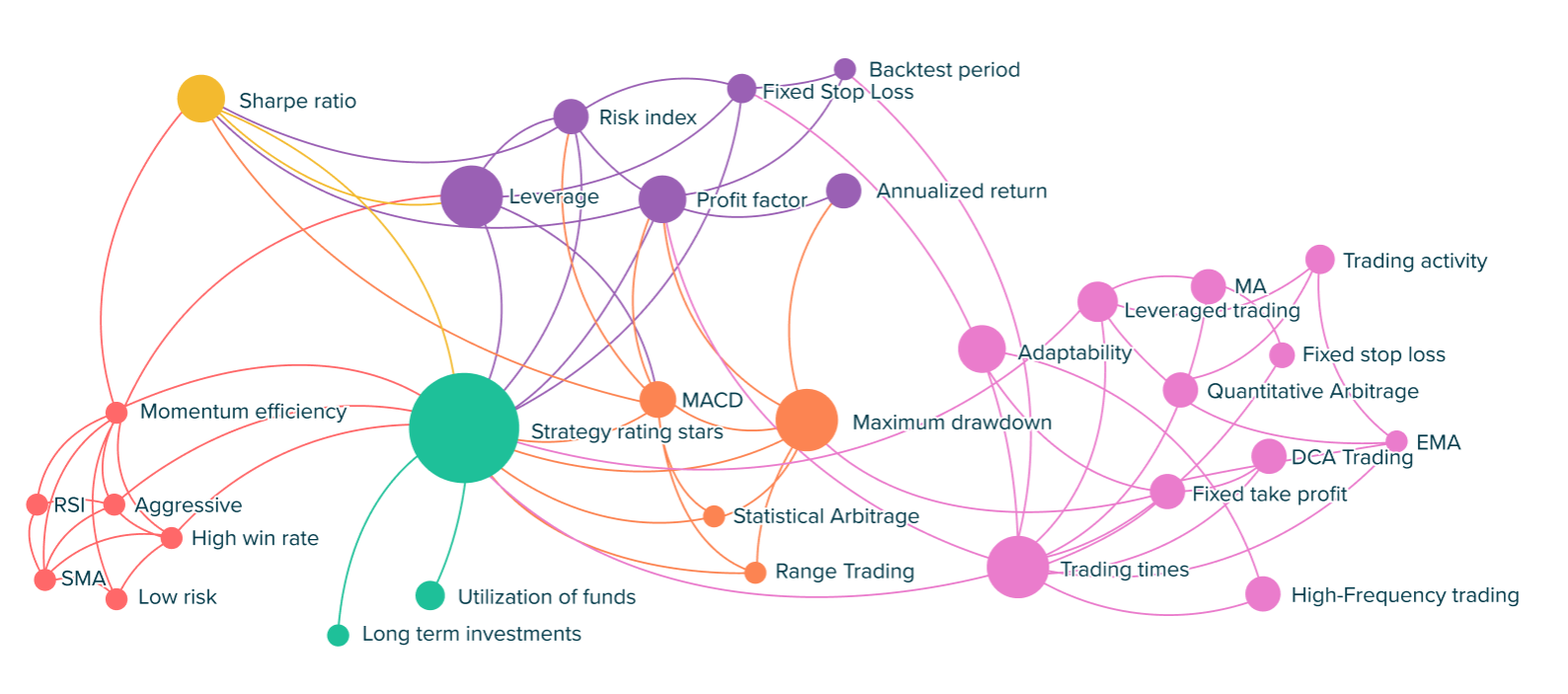

Technical indicators are mathematical calculations based on historical price and volume data. They provide insights into current market conditions and help predict future price movements. Common indicators include Moving Averages, RSI, MACD, and Bollinger Bands.

- Trading Strategy:

Trading strategies define the rules for making trading decisions. They specify when to buy, sell, or hold cryptocurrencies based on data analysis and technical indicators. Strategies can vary, including trend following, mean reversion, arbitrage, and more.

- Risk Management:

Effective risk management is crucial to mitigate potential losses. Algorithms incorporate rules for position sizing, setting stop-loss levels, and managing exposure to reduce the impact of adverse market movements.

- Order Execution:

Algorithms execute trading orders on cryptocurrency exchanges. They can place market orders (executed immediately at the current market price) or limit orders (executed at a specified price or better). Fast order execution is essential due to crypto market volatility.

- Backtesting:

Backtesting involves running the algorithm on historical data to evaluate its performance. It helps identify strengths and weaknesses, refine strategies, and optimize parameters. A well-performing algorithm in backtesting provides insights into potential effectiveness.

- Optimization:

After backtesting, traders may fine-tune the algorithm’s parameters to improve performance. This process includes adjusting indicator settings, timeframes, and risk management rules to achieve better results.

- Monitoring and Maintenance:

Crypto markets are dynamic, requiring continuous monitoring to adapt to changing conditions. Traders may need to update various aspects of the algorithm and refine it as necessary to maintain effectiveness.

- Security:

Strong security measures are essential as trading algorithms interact with online exchanges and sensitive data. Encryption, secure API connections, and adherence to best practices are critical to protect both the algorithm and user data.

- Regulatory Compliance:

- Compliance with relevant laws and regulations is vital, depending on your jurisdiction. Ensuring that the algorithm operates within legal boundaries is crucial to avoid potential legal issues.

In summary, a cryptocurrency trading algorithm is a complex system that combines data analysis, technical indicators, trading strategies, risk management, and more to automate trading decisions. It’s essential to understand the intricacies of algorithmic trading and manage expectations, as no algorithm can guarantee profits, and trading always involves inherent risks. Additionally, platforms like ATPBot provide AI-powered trading algorithms that eliminate the need for users to handle the technical aspects, allowing for a stress-free and data-driven trading experience.