In the ever-evolving landscape of financial markets, AI-driven automated trading strategies have taken the spotlight. However, with an array of choices available, it’s crucial to choose a strategy that aligns with your investment goals and risk tolerance. Here’s a comprehensive guide to help you navigate the process of selecting a reliable AI automated trading strategy.

- Understand Your Investment Goals

Before delving into AI strategies, define your investment objectives. Are you aiming for short-term gains, long-term growth, or a balanced approach? This foundational step sets the tone for selecting a strategy that matches your goals.

- Evaluate Performance Metrics

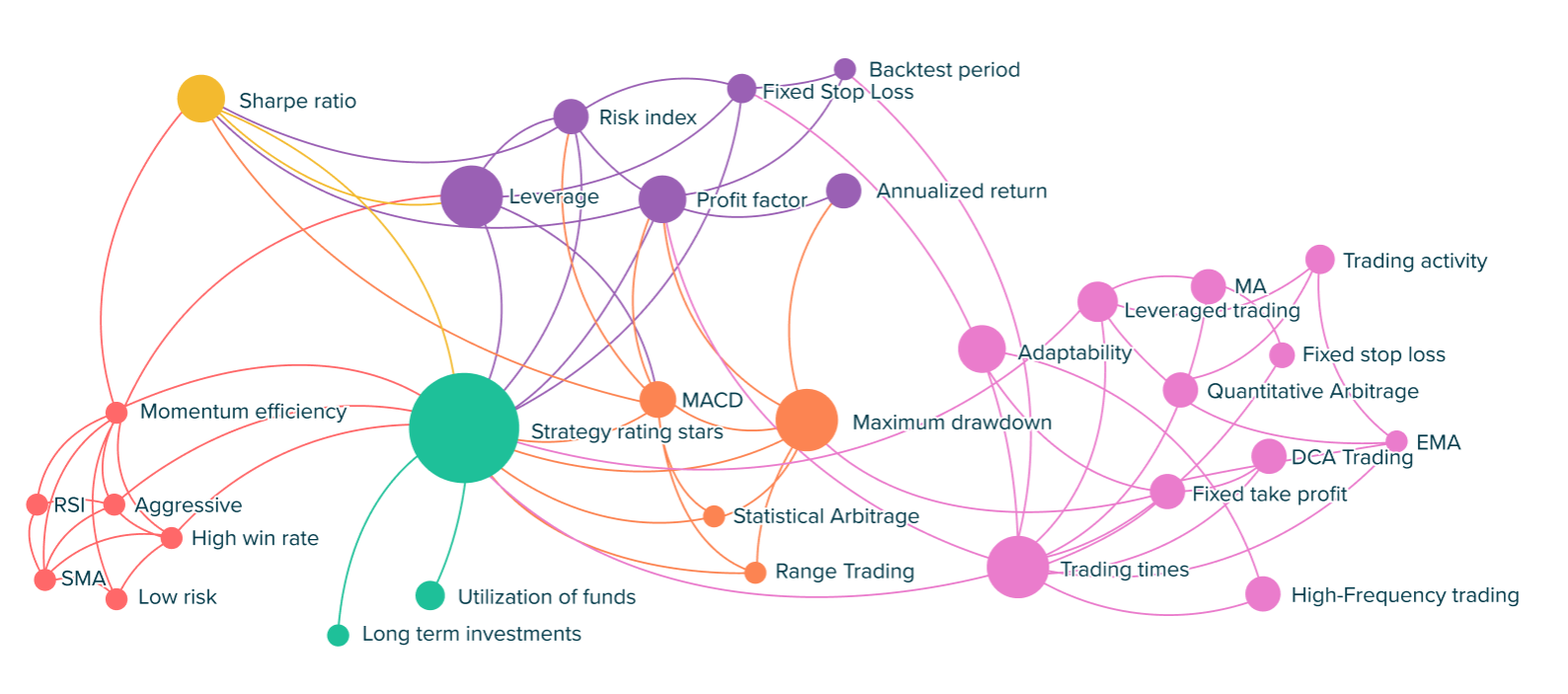

Scrutinize a strategy’s performance metrics, including historical returns, drawdowns, Sharpe ratio, and win-to-loss ratios. Solid performance metrics provide insights into the strategy’s profitability and risk management.

- Backtesting and Data Analysis

Perform rigorous backtesting by applying the strategy to historical market data. This helps gauge the strategy’s effectiveness across various market conditions and verify its consistency.

- Transparency and Explainability

Opt for a strategy that offers transparency in its decision-making process. Understandable trading decisions build confidence in the strategy’s reliability.

- Consider Risk Tolerance

Assess your risk tolerance before choosing a strategy. Ensure that the strategy’s risk management mechanisms, like stop-loss and take-profit levels, align with your comfort level.

- Diversification in Portfolio Fit

Examine how the AI strategy complements your overall investment portfolio. A diversified portfolio helps manage risk effectively.

- Leverage Professional Knowledge

Consider the strategy’s design team. Expertise in quantitative analysis, algorithm development, and financial markets is vital to strategy success.

- Customer Support and Education

A reputable platform should offer robust customer support and educational resources. Access to experts who can address queries and provide guidance is invaluable.

Final Thoughts

Selecting the right AI automated trading strategy requires a systematic approach. Understanding investment goals, assessing performance metrics, backtesting, and ensuring transparency are crucial steps. Combining risk tolerance, diversification, professional knowledge, and excellent customer support ensures a well-rounded decision.

Embrace ATPBot for Your Investment Journey

ATPBot stands as a symbol of innovation in the world of AI-driven trading strategies. With its dedication to transparent, performance-based strategies and unwavering customer support, ATPBot empowers you to make investment decisions that align with your aspirations. ATPBot is a pioneering AI investment platform redefining trading strategies for cryptocurrencies assets. With its commitment to accessibility, transparency, and exceptional performance, ATPBot helps traders thrive in dynamic market conditions and capitalize on profitable opportunities.